First-time homeowners may feel intimidated by the property market. Finding the perfect home requires asking the right questions. This ensures that you are making a competitive offer on a property that you can afford and that satisfies your long-term requirements. These are some questions to ask when buying a new home.

Budget?

Don’t spend time looking at properties before determining your budget. Money is the most significant aspect in choosing a property. Property taxes, homeowners’ insurance, ongoing upkeep, and renovations are extra fees to consider. Due to the additional expenses that come with owning, such as maintenance and homeowner’s association fees, you may not experience any financial advantages for many years.

How is your credit?

This question is crucial for mortgage applicants. A Federal Housing Administration (FHA) loans need a 10% down payment and a 500-credit score. The approval procedure, however, may be challenging, and you will pay a higher interest rate than you would with a better credit score. Higher credit scores lead to easier loan acceptance, cheaper interest rates, and lower monthly payments. Conventional lenders need a minimum 620 score, but a 740 or more will get you a cheaper rate.

A rule of thumb in the mortgage lending market is that you can buy a house if your entire debt, including your monthly mortgage payment, is 43% or less of your pre-tax income. This is your debt-to-income ratio (DTI). If you earn $6,000 per month, your total monthly debt, including your new home payment, should not exceed $2,580 ($6,000 x 43%).

The Location

When buying a home, location is everything. You can modify everything except your home’s location. Consider closeness to employment, home placement, ease of access, neighbor noise, traffic, parks, retail stores, schools, and transit access while house searching.

Were there any new construction or big renovations?

Property records and listing descriptions do not always line up in certain circumstances. A residence may be listed as having four bedrooms, yet one may be a non-conforming addition. What significant repairs or improvements has the seller made? Replaced appliances or systems should have original manufacturer warranties. Knowing a home’s renovation history might help you assess its condition and value.

How old is the roof?

Having to fix a home’s roof soon after move-in might cost thousands of dollars. The lender may demand roof repair if it is damaged before approving your loan. If the listing does not specify the roof’s age, find out so you may prevent pricey repairs.

Health and safety risks?

Lead paint, radon, mold, and other serious risks might delay loan approval. Ask the vendor for proof of prior difficulties and what was done to fix them. If you suspect dangerous concerns or a home inspector recommends more testing, you may have to pay extra.

Is the house in a disaster-prone zone?

High-risk flood zones need flood insurance. FEMA’s Flood Map Service shows whether a home is in a high-risk flood zone. Buying a house in California or another earthquake-prone zone may need earthquake insurance. Have enough homeowner’s insurance to replace your home if it’s damaged. If you’re underinsured and a disaster strikes, you may have to repair or replace your home.

Down payment assistance programs

Local and state housing organizations provide DPA programs that differ by location. Depending on your income, the location you are purchasing in, and other factors, you may be eligible for both down payment and closing cost help.

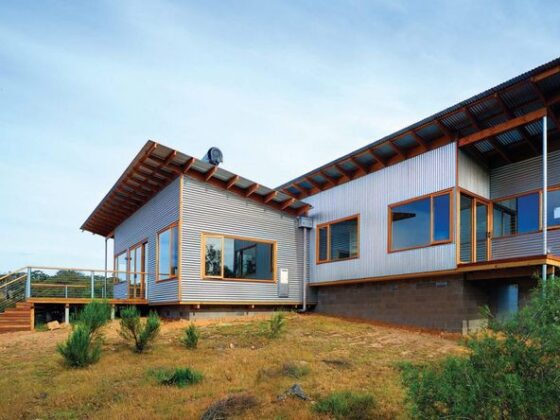

Are you interested in learning more about other affordable housing options such as tiny housing? Read more about what tiny homes are and why they may be the solution for you.

I hope this article has been helpful, build wisely!